Net Asset Value & Market Prices

The Net Asset Value (NAV) of duETS is expected to remain relatively stable. It is calculated as the value of cash and Treasury assets held for each series of duETS — the Trust is limited to holding only cash and U.S. Treasuries. The Treasury income will be added to the NAV, while the management fee and taxes will be subtracted from the NAV. At the end of the Measurement Period, NAV is allocated by formula between Down and Up securities, based on the index level on the Valuation Date.

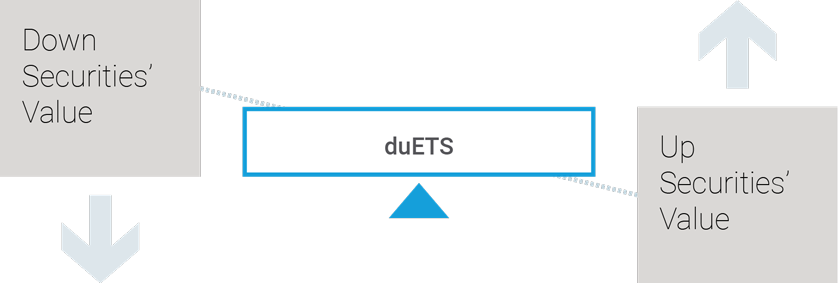

Market prices for duETS during the Measurement Period, however, will be driven by supply and demand for the securities. Market predictions will influence demand, resulting in either the Down or Up trading at a higher level. When one half of the pair trades at a premium, the market price of the other half will sink to a discount.